In the past week, the two main blockchains of the crypto space, Bitcoin and Ethereum, were as congested and blocked as the narrow streets of Tehran, and the users of these blockchains paid a total of 193 million dollars in fees for transactions in these two networks, compared to the previous week. It was 100% more. In this issue of the exclusive analysis of Anchin Mihan Blockchain, we examine this new market trend and examine what BRC-20 tokens are and the consequences of this new phenomenon for the future of the Bitcoin market and network. We also analyze the cause and consequences of the astronomical increase in transaction fees in the Ethereum network.

Disclaimer:

The following report is an exclusive analysis of Blockchain Homeland based on last week’s data from China. The information and analysis in this article should not be considered as a recommendation for buying and selling or investing. Do not forget to always analyze and check the market yourself before investing.

There are various tools to analyze the price of Bitcoin and Ethereum and in general to analyze the general trend of the cryptocurrency market. We believe that by continuously reviewing such information or within the chain, the events and happenings of this market can be evaluated and analyzed more deeply and accurately. In this regard, Blockchain Homeland publishes periodic reports of market performance based on such data. This edition, the 60th report of the series Such analyzes It is the homeland of blockchain. To read the previous report, refer to the following article.

Read: Anachin’s exclusive analysis at the end of 1401; Will the upward trend in the price of Bitcoin continue?

Fee market in Bitcoin and Ethereum networks

For the first time since late 2020, transaction fees on the Bitcoin and Ethereum networks rose simultaneously. The average transaction fee in Ethereum reached $20 last week, and the average transaction fee in Bitcoin increased to $9. Although the average fee in terms of dollars was still lower than the peak of the bull market in 2020 and 2021, it should be noted that, firstly, the parity of Bitcoin and Ether with the dollar has dropped significantly, and secondly, compared to the previous weeks and the bear market of 2022, the recent growth is very high. It has been impressive.

It should be noted that the mechanism for determining fees in blockchain networks is based on supply and demand. The space of each block in the Bitcoin and Ethereum networks is a limited resource, and when the demand for data registration in these blocks increases, applicants must increase their transaction registration priority by offering higher fees to miners. In the Bitcoin network, there is a nominal ceiling of 1 megabyte for the maximum amount of data that can be recorded in a block, and in the Ethereum network, the maximum transaction that can be recorded in a block is set at 30 million gas.

With the increase in demand for recording transactions in Ethereum Bitcoin blocks, Ethereum users paid $33 million in fees on May 5 (15 May) alone, and Bitcoin users paid $12 million in fees to miners on May 7 alone. This was the highest volume of fees paid in one day, in the last year for Ethereum users and in the last 2 years for Bitcoin users. But the heating of the fee market in the Bitcoin and Ethereum networks has underlying reasons that we will discuss further.

BRC-20 tokens and the effect of this new trend on the Bitcoin economy

The astronomical increase in fees on the Ethereum network is not a new issue, but the astronomical increase in fees on the Bitcoin network is a more recent issue. The low transaction fees in the Bitcoin network due to the exponential reduction of the reward for extracting each block with successive halvings has always been one of the concerns of Bitcoin fans. The mining subsidy per block is currently 6.25 BTC and this incentive will decrease to 3.125 BTC with the next halving.

In the distant future (around the year 2140) there will come a time when the block mining reward will reach zero, and at that time the only economic incentive for miners to continue mining will be transaction fees. In such a situation, either the price of Bitcoin must have grown strongly, or the influence of Bitcoin must have expanded greatly, and the demand for block space must be very high, so that the continuation of mining is still economically justified.

One of the phenomena of 2023, which controversially increased the demand for block space in the Bitcoin network, was the “Inscription” phenomenon in the Bitcoin network, which uses the Ordinals protocol and the use of satoshi metadata to issue NFTs in the Bitcoin network. Began. This new source of demand for block space caused an increase in the volume of transactions in Mempool Bitcoin, but until the last week, it did not have a significant impact on transaction fees.

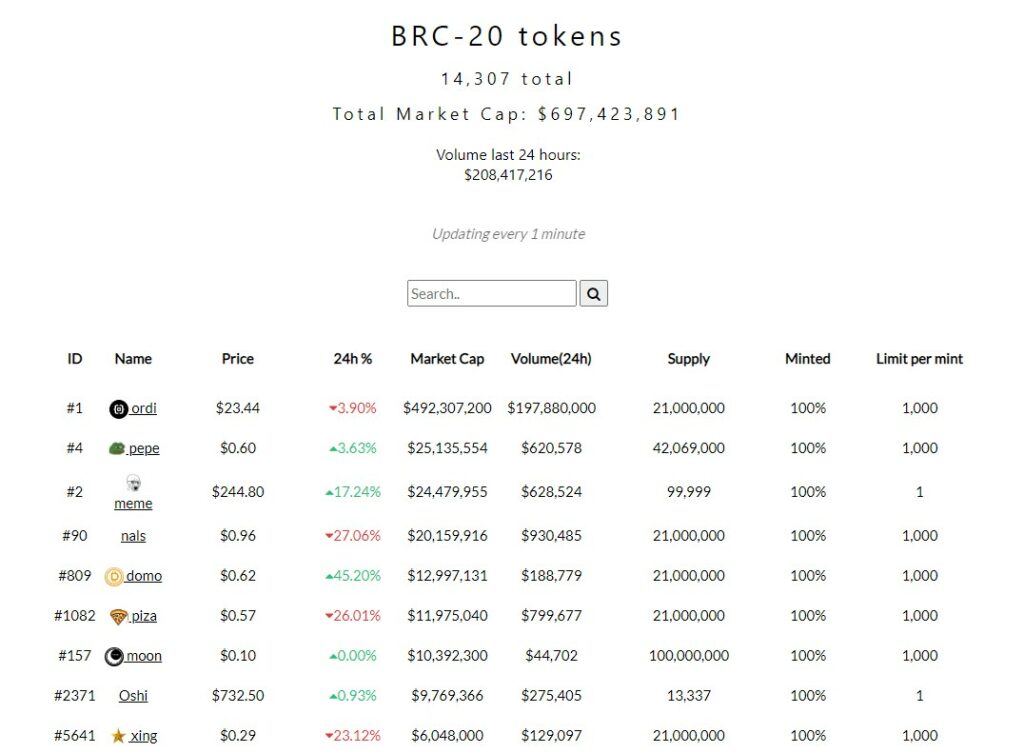

In the last week, with the fever of meme coins, a new wave of Inscription transactions was formed in the Bitcoin network. This new wave used an experimental standard to create fungible tokens on the Bitcoin network. This standard, which was inspired by the well-established standard of issuing tokens in the Ethereum network (ERC-20), is called “BRC-20” and was introduced at the beginning of March, until the fever of memecoins heated up in the last week. It was not noticed. However, within the last week, about 14,000 different tokens of this type were formed on the Bitcoin network, and their total market value reached about 1 billion dollars for a while.

One of the BRC-20 tokens called Ordi has reached a market value of half a billion dollars and centralized exchanges such as Crypto.com and Gate.io decided to list it. Binance also announced that it will add support for Ordinals tokens to its NFT market.

The number of BRC-20 transactions has been increasing for the past 2 weeks, but in recent days, it has set impressive records. The number of these transactions reached about 397,000 transactions on May 7. To date, about 4.1 million BRC-20 transactions have been recorded on the Bitcoin blockchain, and miners have been paid about 869 BTC for recording these transactions.

Another interesting point is that BRC-20 transactions have taken over the overwhelming majority of Ordinal transactions in a very short period of time. The number of ordinal transactions other than BRC-20 (including for issuing NFTs) has been about 644,000 to date, and miners have earned about 120 BTC from the registration of these transactions.

Another interesting point is the huge share of Ordinal transactions in the total transactions of the Bitcoin network in recent days. These transactions accounted for 53% and 65% of Bitcoin blockchain transactions on May 1st and May 7th, respectively.

The flood of these types of transactions made the total number of transactions on the Bitcoin network record a new ATH. The total number of transactions on the network in recent days exceeded 600,000, while the historical peak of the number of transactions, which occurred on December 14, 2017, was 490,000 transactions.

Also, the share of BRC-20 transactions in Bitcoin network fees on May 7, 8, and 9 averaged a staggering 44% (equal to 216 BTC).

This new phenomenon is a very pleasant phenomenon for miners according to the reviews we had. But on the other hand, it has caused differences among the community of Bitcoin fans.

Some Bitcoin maximalists consider the flood of BRC-20 transactions, which led to higher network fees and an increase in unconfirmed transactions, to be a DDoS attack on the Bitcoin blockchain. While others believe that all significant innovations in other digital currencies will eventually make their way to the Bitcoin network. Although the BRC-20 standard is a weak imitation of Ethereum’s ERC-20, the introduction of these tokens opens the way for new use cases to be added to the Bitcoin network. For example, it is possible in the near future to trade BRC-20 tokens in decentralized exchanges relying on “Partially Signed Bitcoin Transactions (PSBT)” to form.

It should also be noted that the Bitcoin network is not unable to solve the transaction fee problem and has a very good solution called “Lightning Network”. Continued congestion of the network by BRC-20 transactions could expand the use of the Lightning network. Moreover, after suspending Bitcoin withdrawals twice due to network congestion on May 7, Binance announced that it will upgrade its payment infrastructure and support the Lightning network.

On the other hand, increasing the mining reward in the long term increases the security of the network. In recent days, the average block mining reward has reached more than 11 bitcoins because people who want to issue BRC-20 tokens have to offer a fee of more than 600 satoshi per virtual byte (SAT/vB) to ensure that their transaction is registered.

Even if conservative supporters of the Bitcoin network disapprove of this type of activity and consider it a form of vandalism, there is practically no good technical solution to stop BRC-20 transactions. In the end, it is the market mechanism that will determine whether BRC-20 tokens will gain a solid foothold or be forgotten by the mimecoin fever like many other efforts to add DeFi and NFT to the Bitcoin network.

Memecoin-mania and the Ethereum network

Before the Bitcoin network, the Ethereum network experienced astronomical fees. During the last week, in some Ethereum blocks, the base fee reached 300 GWEI, and at times, users had to pay a fee of $300 to bridge a few dollars to the Ethereum network.

The main reason for this congestion was the influx of users to trade memecoins and mainly PEPE. One of the interesting points of the influx of users to buy this ethereum-based memecoin was the effect it had on the NFT market. Last week, the number of transactions related to ERC-721 tokens (the standard for NFTs on the Ethereum network) decreased significantly, while the number of transactions for ERC-20 tokens (probably due to PEPE moves) increased significantly. It was also observed that capital migrated to PEPE from some important Ethereum network NFTs including BAYC.

In addition, it should be noted that after the London hard fork of Ethereum, on the other side of the increase in Gas Fee, there is an increase in ETH token burning, the ultimate goal of which is to turn Ether into an anti-deflationary cryptocurrency.

The result of these high fees was that more than 14,000 Ether were burned on May 5th alone, which is the highest daily token burn for Ether since the Merge update. Due to the daily staking bonus of about 2000 Ether, the circulating supply of Ether decreased by about 12,000 units on this date alone. This suggests that the dream of ether being anti-inflationary may not be unattainable.

Just as what happened with the BRC-20s for the Bitcoin network highlighted the importance of expanding support for the Lightning network, Ethereum’s Layer 1 congestion re-emphasized the importance of Layer 2 solutions such as Arbitrum and Optimism. Ethereum’s next update, called Cancun, will help reduce layer 2 transaction fees by implementing EIP-4844.

final word

We find in this series of articlesInformation about such a marketWe go and try to identify common repeating patterns between price and On-Chain information and provide you with it. As a result of this article and all the things mentioned in it, it should not be used as a decision criterion for investment. Instead of directly analyzing the price, we try to know the factors influencing the price fluctuations of cryptocurrencies in order to have a more accurate analysis of the market. If you have experience in this field or you have found information about that specific China that affects the price of cryptocurrencies, share them with us.

خبر فوق به نقل از رسانه اسمارتک نیوز در وبسایت اسمارتک نوشته شده است در تاریخ 2023-05-10 21:01:00